How to Quote Medicare Advantage, Medicare Supplements, and Medicare Part D Prescription plans in Hawaii

Speak to a licensed local insurance agent.

1-866-696-8636

Yes, we are local, and we can help.

HOW TO QUOTE MEDICARE ADVANTAGE, MEDICARE SUPPLEMENT, AND MEDICARE PART D IN HAWAII

Free Instant Quotes are available here if you’re ready to get started.

Here’s a guide below on how to run quotes for all types of Medicare plans so you’ll know what preparation is needed to get the best value and pertinent information from your Hawaii Medicare online quoting and enrollment.

HOW TO QUOTE MEDICARE SUPPLEMENTS IN HAWAII

Medicare Supplements are the same product benefit design nationally so it makes it easier to compare. Insurance carriers offer the base plan designs so premium price and carrier stability become more important.

About 80% of Medicare Supplement customers purchase the G Medicare Supplement.

Why?

Because the G Medicare Supplement covers almost all of the ‘gaps’ in medicare, which are the portions you pay, except for the Part B outpatient Physicians Services deductible.

We can’t recall a customer unhappy with the G Supplement because:

– you get PPO style national coverage with the Original Medicare Provider Network

– affordable premiums vs. what you pay on pre age 65 plans

– extremely low out of pocket costs on actual medical expenses when they occur.

The instant quotes will show you the major insurance carriers and G supplement plans in a side by side view comparison.

If you’d like some help or want to talk it over give us a call at 1-866-696-8636 or email is help@plansforhealth.com

Don’t forget! If you do purchase a Medicare Supplement (combined with Original Medicare) you will need to buy a Medicare Part D plan to cover your prescription.

Learn more about Medicare Part D RX prescription plans in Hawaii here.

Run an instant quote here to compare Hawaii Medicare Supplements (focus on the G plan) and apply now. Or call us and we’ll enroll you over the phone 1-866-696-8636.

HOW TO QUOTE MEDICARE ADVANTAGE PLANS IN HAWAII

Quoting Medicare Advantage Plans = Part C (which bundles Medicare A, B, & D) is little more involved than getting a Medicare Supplement G plan instant quote.

With Medicare Advantage you will want to make sure your plan is contracted with your preferred medical group, hospital, and covers your prescription drugs.

What will you need to gather to prepare for your instant Medicare Advantage plan? Make sure to get the following information:

-MEDICAL PROVIDERS: doctor, medical group, and hospital names for potential usage

-PRESCRIPTIONS: your maintenance prescription full names, dosages, and frequency taken

-PHARMACY: potential pharmacies you might utilize

For help with questions you can call, email, or schedule a formal consultation appointment with us on the calendar if you prefer to prepare.

TOTAL COST

Make sure you’re considering on the list any possible medical providers (doctors, hospitals, & medical groups) which might be missing from the cost analysis.

Once you’ve entered this information into our instant quoting system, you can sort the plans by ‘total cost’ which includes cost of monthly premium and medical out of pocket expenses on both prescription drugs and general medical claims.

This exercise should also be completed for prescription drugs. Make sure you are examining the covered prescription list for your medications, or Contact Us and we’ll help you do it.

What else to be worried about with Hawaii Medicare Advantage plans?

TOTAL COST

There is a total cost of ownership type analysis to be done.

Don’t get sucked into simply buying the cheapest monthly premium plan!

TOTAL COST= premiums + max out of pocket/deductible + prescription copays/coinsurance

The cheapest plan isn’t necessarily the plan with the lowest monthly premiums. This is particularly true if you have maintenance prescriptions you take monthly where you are guaranteed cost out of pocket.

Consider your average monthly medical expenses as well, THEN make the decision.

Deductibles can range from Zero to $5,000+ easily, so make sure you’re checking deductible size.

Max Out of Pocket, which is the combination of medical expenses including deductible, co-pays, and any coinsurance percentages you may be responsible for.

NOTE: On a Medicare Advantage Plan, the medical max out of pocket does NOT include the prescription max out of pocket for the Medicare Part D plan bundled inside the MAPD combined plan (Medicare Advantage Prescription Drug) plan. A MAPD plan is a standard Medicare Advantage plan.

So, be prepared if you have several prescription drugs taken on a monthly basis to budget separately for these drug costs from your general medical care costs.

For example, if you have a $5,000 max out of pocket on your Medicare Advantage plan, and a $2,000 max out of pocket listed for Medicare Part D prescription drugs, your total risk is the combined $7,000.

Simple math, I know but worth pointing out as an often overlooked cost.

Best news is, if you enter your prescriptions into our INSTANT QUOTING system we will tell you which plan is the cheapest including your monthly prescriptions.

Simply completely enter your exact monthly maintenance prescriptions with full name, pharmacy, dosage, and frequency. Then hit the sort by ‘total cost’ premiums + prescriptions costs button and you’re home free.

DOCTORS

You might see doctors listed as ‘in or out’ of network. Something like “2 of 5 Provider Locations covered,” for example seen below.

There’s two possible issues if you believe the doctors are in the plan’s provider network because they work in the same medical group.

You would think doctors in the same medical group would sign contracts with the same health insurance plans.

Here’s how to investigate:

Click the ‘Edit’ button under Providers to check the location selected for the doctor. It’s possible for a doctor to practice at several locations but under different circumstances (medical group or practice) at each location. Sometimes we’ll see doctors with a dozen addresses listed but the location needed for your medical group is only one.

A doctor potentially has admission privileges at a certain hospital, but decides separately whether or not to participate in a certain medical plan contract as a physician.

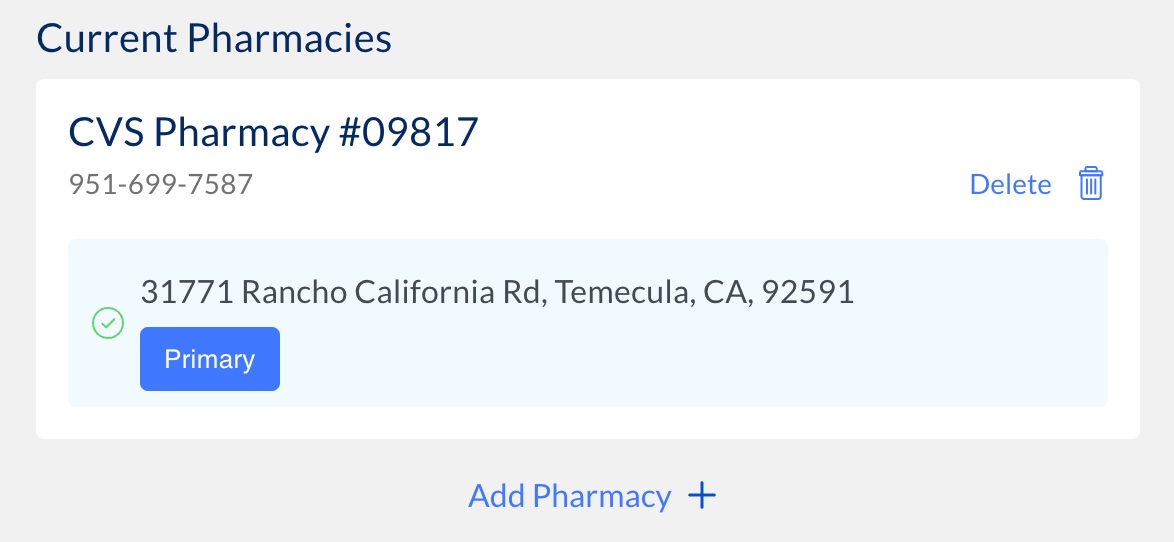

Local Pharmacy

Don’t forget your local pharmacy. Distribution includes your local retail pharmacy. Make sure to check to see if your default pharmacy is contracted on your Medicare Advantage plan, ‘in-network.’

Don’t forget your local pharmacy. Distribution includes your local retail pharmacy. Make sure to check to see if your default pharmacy is contracted on your Medicare Advantage plan, ‘in-network.’

The update pharmacy section looks like this:

You can check by entering your favored local pharmacy into INSTANT QUOTE and the system will tell you instantly.

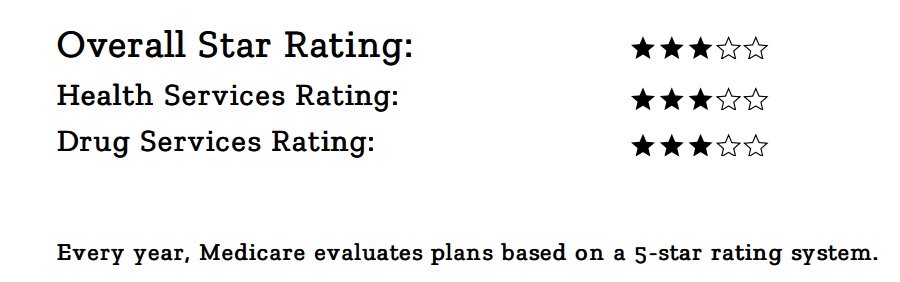

Star Rating

Although something as easy to disregard as a customer satisfaction system called ‘STAR RATING’ sounds, in this case Medicare Advantage and Medicare Part D plans with bad customer experiences do tend to get lower STAR ratings.

CMS Center for Medicare Services (the federal government) uses a customer experience rating system called STAR rating to provide the consumer with a plan rating giving a potential customer some insight into a variety of experiences based on customer satisfaction including:

Claims processing

Billing

Customer Service

Doctor Provider Network

Prescription Drug Pricing and Accessibility

The STAR RATING data is captured via surveys and feedback from all the participants on all sides of the participants in the system like members, providers, operations, distributors, pharmacies, etc.

- SPECIAL CIRCUMSTANCES

WHAT IF YOU HAVE A CHRONIC CONDITION OR ARE LOW INCOME?

Do you think you may have a special circumstance? If you are receiving government assistance due to low income on Medi-Caid or deal with a chronic medical condition you may get some extra help.

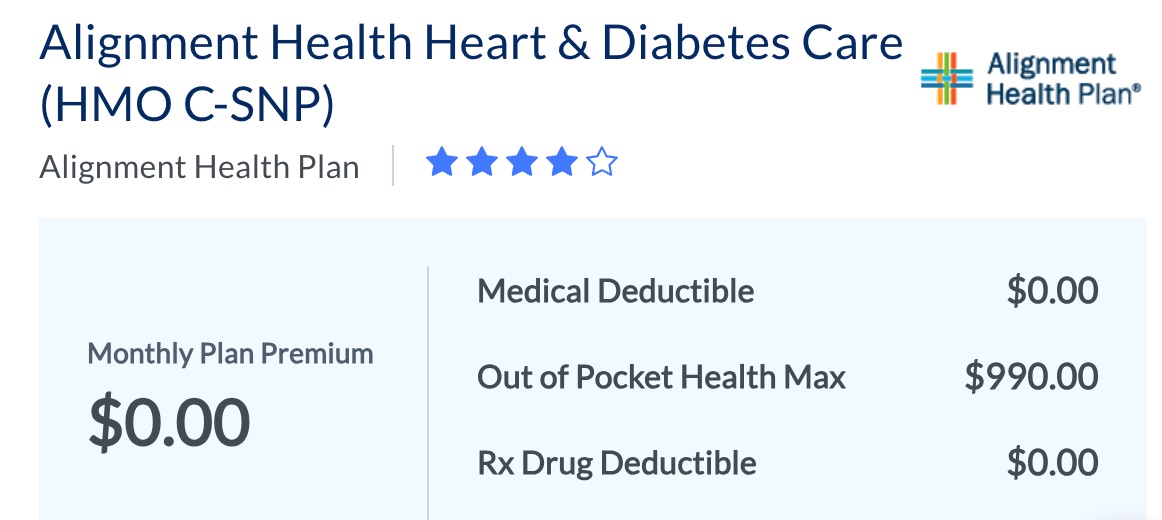

When running your instant quote check the filter option for ‘SNP’ or ‘D-SNP’and you’ll immediately see the plans available which offer additional coverage for qualifying applicants. Catchy names we know.

Alignment Health Plan above, for example, offers a Chronic Condition Special Needs plan for members with chronic heart and diabetes issues.

If you have a chronic condition or are low income call us at 1-866-696-8636 and we’ll advise if there’s a Special Needs plan for you.

How to Quote Medicare Part D Prescription Plans in Hawaii

Medications.

So much of medical care is prescription based these days for better or worse.

To view only the Part D prescription plans, sometimes called PDP RX click the tab within our general quoting for Prescription Drug Plans or directly quote and enroll here:

Then, take these steps:

*Enter full names of your maintenance prescriptions including dosages and frequency taken.

This is extremely important!

Taking a few minutes to get this information right up front can save you a world of headaches and cost later.

*Then enter any preferred pharmacies and sort by ‘total cost’.

Some helpful pro tips at this point once your initial quote is run:

Prescription Coverage

-Check to see if your medication is showing up as a covered medication or not. It will be green colored if it’s a covered formulary medication. If it is non covered medication check to see if you’ve selected an option which precludes covered status.

The red circle in the quoting engine means the prescription is out of network or non formulary.

This is bad.

What it means is you need to investigate further and check to see if there’s any way to get it covered.

For example, check to see if you’ve selected some of the following choices and try your quote with another option:

-brand selected instead of generic

-capsule selected instead of tablet

-compounded medication option for what is typically a basic medicine

Some medications are just not covered by any Medicare or Medicare Part D rx plan.

Drugs for cold or cough symptoms, anorexia, weight loss or gain, erectile dysfunction, and fertility.

Ozempic, for example, is not covered by Medicare for weight loss. It is covered under some diagnosed medical conditions though.

PHARMACY

Check closely to see if your selected pharmacist is listed as a covered pharmacy. Look for the green check box.

If it’s red and out of network, then you would be best served either finding a different pharmacy or a different Medicare Part D insurance plan.

Otherwise you will pay more for your prescriptions out of pocket.

Just want to talk it over? Give us a call at 1-866-696-8636.